Welcome to Blue Federal Credit Union

Welcome Kit

Our Welcome Kit, which will be sent to members in August, is packed with valuable information about the merger and your new membership benefits. Consider it our warm “Welcome to the Blue family!”

Conversion Kit

Our Conversion Kit contains all the information you need to know about accounts, routing numbers, and more.

Important Dates

Mobile deposits through Aventa’s online and mobile banking will be available until Monday, September 23, 2024, at 5:00 PM. You will be able to make deposits at branches or through ATMs.

Aventa.com Site Decommission

All traffic from aventa.com will be redirected to a special ‘Welcome to Blue’ landing page on bluefcu.com. The page includes instructional videos for navigation and tips for locating pages that were frequently used on aventa.com.

Aventa Online & Mobile Platform Decommission

The platform will no longer be available on app stores or through aventa.com. Blue Digital will serve as your online and mobile banking replacement beginning Tuesday, October 2, 2024.

System Conversion

Aventa will transition to Blue’s core banking system for all banking processes.

Branches will be open, with staff available to assist with emergency transactions and questions.

Continue using your debit and credit cards as usual; ATMs will function as usual during this period (balances will not update until Wednesday, October 2, 2024).

CO-OP Shared Branching

Shared Branching services will be unavailable due to the system conversion.

You can resume mobile deposits using Blue Digital. Refer to the Digital Banking Setup instructions by visiting bluefcu.com for more details and to access tutorials to assist you with navigating the platform.

Your Aventa account history from the last 12 months will be available in Blue Digital through eStatements by October 31. For assistance with your statements, contact us at 1-800-555-6665.

Frequently Asked Questions

At Blue Federal Credit Union, we want to ensure all members receive the best experience possible. The conversion will align the products and services of all members to our processing system, allowing us to provide seamless support to all members. This operational conversion is the final step in our merger process.

Your Aventa Credit Union membership will automatically transfer to Blue Federal Credit Union. No need to worry—your membership is safe with us.

The data system conversion will happen from the close of business on Monday, September 30, through Wednesday, October 2. During this time, online and mobile banking will be unavailable. However, you may still use your debit card and write checks. All previously scheduled bill pay and/or automated ACH items will still be process as planned.

Please note, branches will have limited system access during the conversion but can assist with non-transactional inquiries.

For help, visit your local branch or call us at 1-800-555-6665.

Starting Wednesday, October 2, 2024, your account number will include a three-digit prefix. This minor adjustment is essential for the system conversion.

Effective Wednesday, October 2, 2024, your new routing number will be 307070034.

Your debit card and checks will continue to work as usual without interruption during the conversion. You can order new checks on October 2, 2024, using your new account and routing numbers.

No, existing automated payments or deposits do not need updates; they will continue without interruption. Use your new account and routing numbers to add new payments after October 2, 2024.

Deposits will not be processed in branches during the system conversion on Tuesday, October 1, 2024, but will resume on Wednesday, October 2, 2024. ATMs will be available for deposit and withdrawal transactions throughout the period, though balance inquiries and updates will not update until Wednesday, October 2, 2024.

Mobile deposits through Aventa’s platform will be available until Monday, September 23, 2024, at 5:00 PM. Starting Wednesday, October 2, 2024, you can resume mobile deposits using Blue Digital.

ATMs will be available for deposits and withdrawals. However, balance inquiries and updates will not be updated until Wednesday, October 2, 2024.

Your Aventa credit card will continue to function as usual with no immediate changes. However, branches cannot accept payments on your credit card accounts from Friday, September 27, 2024, through Tuesday, October 1, 2024. You can make payments online or on mobile via Aventa CC app. You may also contact Cardholder Services at 1-866-609-7676.

Starting Wednesday, October 2, 2024, you will gain online and mobile access to your accounts via Blue Digital. Instructions on how to set up your online and mobile banking are available in the Membership Conversion Kit or on bluefcu.com.

Your Aventa account history from the last 12 months will be available in Blue Digital through eStatements by October 31. For assistance with your statements, contact us at 1-800-555-6665.

Starting Wednesday, October 2, 2024, you can make loan payments through Blue’s online portal (bluefcu.com/manage/pay-my-bill/), visit any branch, or call 1-800-555-6665.

No, your mortgage loan servicing will remain unchanged during the conversion.

Effective Monday, September 30, 2024, the Aventa.com website will be permanently redirected to BlueFCU.com. The redirect will lead to a ‘Welcome to Blue’ landing page containing helpful information relating to the system conversion.

As we approach completing the merger, we’ll send you important documents with details about your account and any actions you need to take. Keep your contact info current so you receive everything you need. Please visit blueaventa.com for the latest news and updates.

If you have any questions or need assistance, please contact us at 1-800- 555-6665 or visit your local branch. We also encourage you to visit blueaventa.com and reference the FAQ section for up-to-date details.

Security is our top priority, and we will take every precaution to ensure your account information remains protected as we complete the conversion.

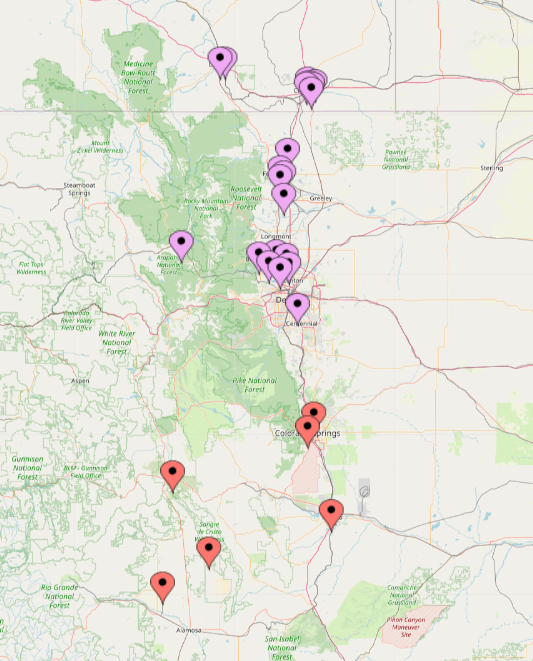

Our New Footprint

Now merged as Blue Federal Credit Union, we handle combined assets of more than $2.1 billion and have over 140,000 members worldwide.

By bringing the Aventa and Blue together, all members have access to expanded products and services, the latest digital banking technology, and best-in-class member service at 27 branch locations, our Contact Center, and our ATM/VTM network.

Our Timeline

The 'no-reply@aventa.com' email domain will be changed to 'do-not-reply@comms.bluefcu.com'.

Aventa branch signage was replaced with Blue Federal Credit Union signage.

Look out for your Welcome Kit in August! Packed with valuable information about the merger and your new membership benefits, it will include a brief welcome message, branch listings and map, and FAQs. Consider it our warm "Welcome to the Blue family!“

We’re committed to keeping you well-informed every step of the way. In September, you’ll receive a Conversion Kit detailing the system conversion. This will include new account numbers, routing numbers, instructions for changing auto bill payments and direct deposit, and the process for ordering new checks, credit cards, and debit cards.

Aventa will maintain its current name and all products/processes until integration occurs later in 2024.

Products and Services

As Blue and Aventa merge, we are exploring enhanced products, services, and member benefits to help shape a future full of innovation and member satisfaction.

What’s Coming?

- Enhanced Member Experience: Experience a journey that’s more seamless and personalized than ever before.

- Expanded Access: Discover a broader range of products, services, and resources.

- Enhanced Technologies: Benefit from the combined technological advancements of both Blue and Aventa.

- Innovative Product Offerings: Explore products designed to cater to your evolving needs.

- Product Differentiation: Expect new industry standards set by our unique offerings to help you achieve your dreams.

To explore the wide array of exciting products and services currently available at Blue, you can visit bluefcu.com.

Keep revisiting this page frequently for amazing and exciting updates ahead!

Checking & Savings

Lending & Credit Cards

Business Banking

Mortgages & Home Lending

Financial Planning

Insurance

To stay up to date on product changes, we also recommend following Blue on your preferred social platform:

Contact Us

Questions or comments?

About Blue

Blue Federal Credit Union, a renowned financial institution, holds a strong presence worldwide, managing over $1.8 billion in assets and serving over 120,000 members. Blue FCU’s mission, "to discover pathways to your possibilities," reflects its commitment to creating opportunities and delivering quality products to its members across diverse regions. It emphasizes diversity, inclusion, and community service, contributing to local organizations in the various regions it serves. Blue FCU’s dedication extends beyond banking services, aiming to make a substantial positive impact across Northern Colorado and Southern Wyoming.

On the web: Blue Federal Credit Union